Table of Contents

Overview

Note

This article covers how to reconcile your Jobber Payments with QuickBooks manually. To start syncing Jobber Payments fees and payouts to QuickBooks, check out our article on How Jobber Payments Fees and Payouts Sync to QuickBooks Online. Syncing payouts will save you time spent on reconciling.

When you do not have payout syncing enabled in your QuickBooks Settings, Jobber Payments sync over to Quickbooks with the full amount of the payment allocated to "Unapplied funds" or "Undeposited funds". These payments then need to be reconciled to your correct Chart of Accounts within QuickBooks.

The amount deposited to your bank account though is the total minus the processing fees. This is because Jobber Payments takes off the fee from each transaction before depositing it.

Reconciling deposits and payments to account for the Jobber Payments fees is done within QuickBooks. This is very similar to how you would handle processing fees for other credit card processors, such as PayPal.

When your bank account also syncs into QuickBooks, you’ll have two "unapplied" payments for the same Invoice. The payment note comes from Jobber and the deposit note comes from your bank account. The deposit note is the Jobber Payments payout less the credit card fees. You will need to enter an adjustment for your credit card fees in the QuickBooks deposit section after matching up the deposit with the invoices from Jobber.

Jobber Payments Reports

You can find the total fees in two places: the Jobber Payments Payouts Report and the Transactions Report. You can find both of these reports by clicking the Reports tab from the sidebar.

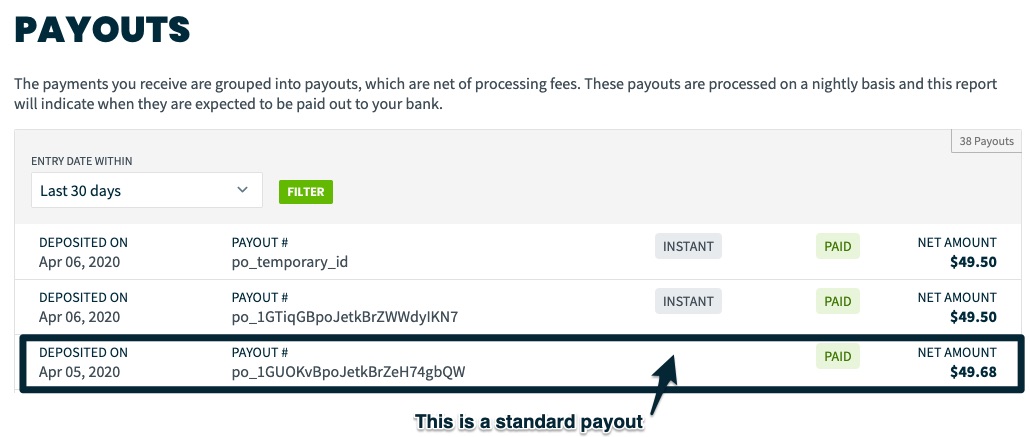

The Jobber Payments payouts report will show each payout of funds into your bank account, including instant payouts and instant payout fees. For reconciling with your QuickBooks account, make sure you are opening a standard payout. These payouts won't show an 'Instant' label.

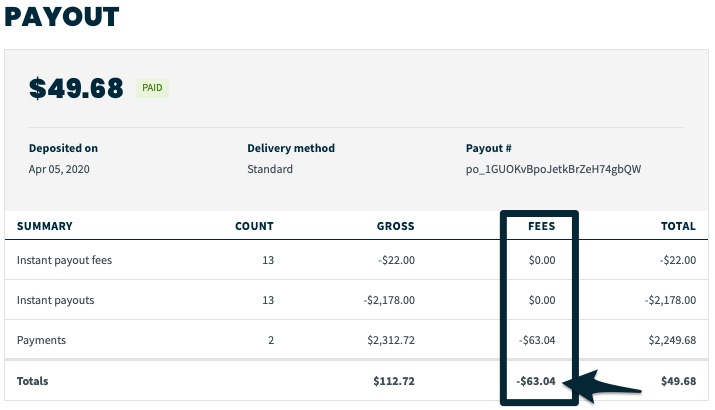

If you click into a standard payout, it will show the summary of the payout showing the number of transactions, gross amount, fees, and the total. You can use the amount listed under fees as your adjustment in QuickBooks. This is probably the most straightforward way to see the total fees in a payout.

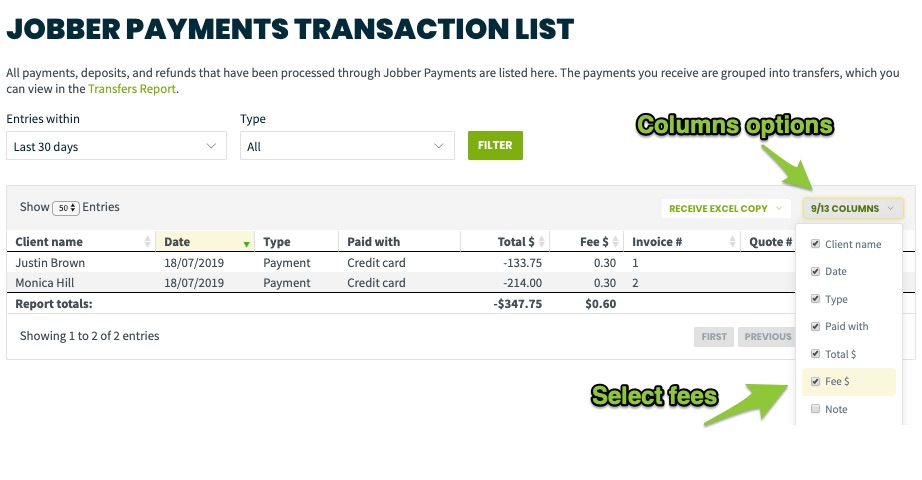

Another way to calculate the fees for a payout is by using the Jobber Payments Transaction Report. In this report you can see the exact amount of fees that were charged per transaction. You might need to click the "Columns" button to have it show the Fees column. Filter this report for the specific date range of all transactions that appear in the payout to find the fees for that payout.

Additional Resources

We found this helpful article that is a good walkthrough for how to handle this in Quickbooks: How To Enter Merchant Fees

If you need a refresher on the reconciliation process in QuickBooks Online, here is a tutorial that goes over this process: https://quickbooks.intuit.com/learn-support/en-us/bank-reconciliation/how-to-reconcile-an-account-statements-records-more/00/344822

We recommend consulting a certified accountant if you have any accounting questions.